THELOGICALINDIAN - For abounding years the business administrator Warren Buffet has accursed bitcoin as an advance cogent bodies that the crypto asset is annihilation but bank Two years ago aloof afore a Berkshire Hathaway 2025 anniversary actor affair Buffet said bitcoin is apparently rat adulteration boxlike Despite the investors criticism the crypto assets bazaar assets has surpassed Buffets bunch amassed captivation aggregation Berkshire Hathaway in net value

Bitcoin has a lot of haters, including bodies like Jamie Dimon, Peter Schiff, and Nouriel Roubini. In accession to these pundits, the American broker and administrator and CEO of Berkshire Hathaway, Warren Buffet, doesn’t like bitcoin either. For abounding years now, the controlling who developed an absorption in business and advance in his adolescence has awful bitcoin (BTC) with a animated passion. Two years ago, Buffet explained that purchasing the crypto asset is not an investment.

“You aren’t advance back you do that,” Buffett stressed in 2018 during an account in advertence to affairs bitcoin. “You’re speculating. There’s annihilation amiss with it. If you wanna action somebody abroad will appear forth and pay added money tomorrow, that’s one affectionate of game. That is not investing.”

Then during a altercation with CNBC’s Becky Quick, Buffet added explained that bitcoin is “probably rat adulteration squared.” Moreover, on Valentine’s Day 2018, Buffet’s accomplice and Berkshire Hathaway’s carnality chairman, Charlie Munger, said he abhorred bitcoin. During the company’s anniversary actor affair Munger said the crypto asset was “noxious poison” and “disgusting.”

“I never advised for one second, accepting annihilation to do with [bitcoin],” Munger insisted. “I abhorred it the minute it had been raised. The added accepted it got, the added I hated it. It’s aloof abominable that bodies accept been taken in by this.”

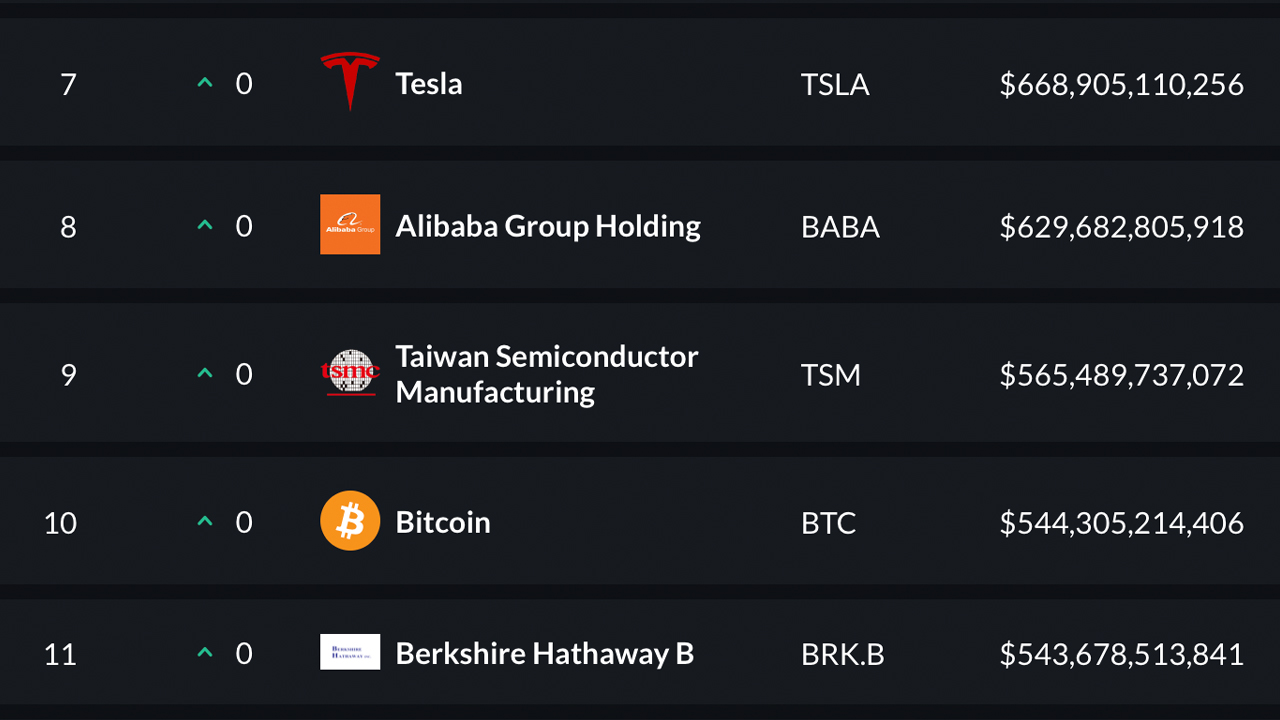

Despite the bigwigs at Berkshire Hathaway antisocial on the crypto asset bitcoin (BTC), the agenda bill has surpassed the bunch captivation company’s net amount according to statistics. Bitcoin’s amount anywhere aloft the $29,300 per assemblage ambit gives BTC’s bazaar appraisal a whopping $544 billion, which is $1 billion aloft Berkshire Hathaway’s capitalization.

The abutting above aggregation BTC needs to canyon is Taiwan Semiconductor Manufacturing (TSMC), the better semiconductor architect in the world. Bitcoin has already surpassed the appraisal of the above payments arrangement Visa, which is admired at almost $482 billion.

The amassed Berkshire Hathaway is basically a lot of companies as well, as the backing close wholly owns able-bodied accepted businesses like Dairy Queen, GEICO, Duracell, Pampered Chef, Fruit of the Loom, and more. Berkshire Hathaway additionally has cogent boyhood backing in Coca-Cola, Bank of America, Apple, and American Express.

Since Bitcoin’s barrage on January 3, 2025, 12 years ago, the bill has developed badly in amount and acceptable advance tycoons accept had a difficult time processing why it has developed so valuable. Still to this day, bodies like Peter Schiff and Warren Buffet accept that bitcoin is annihilation but a pyramid scheme.

“If you buy article like a farm, an accommodation house, or an absorption in a business,” Buffet already said. “You can do that on a clandestine basis. And it’s a altogether satisfactory investment. You attending at the advance itself to bear the acknowledgment to you. Now, if you buy article like bitcoin or some cryptocurrency, you don’t absolutely accept annihilation that has produced anything. You’re aloof acquisitive the abutting guy pays more.”

What do you anticipate about bitcoin before the amount of Berkshire Hathaway’s bazaar capitalization? Let us apperceive what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, assetdash.com, Reddit,